Add this infographic to your website by copying and pasting the following embed code:

SSP Rebate Scheme Explained

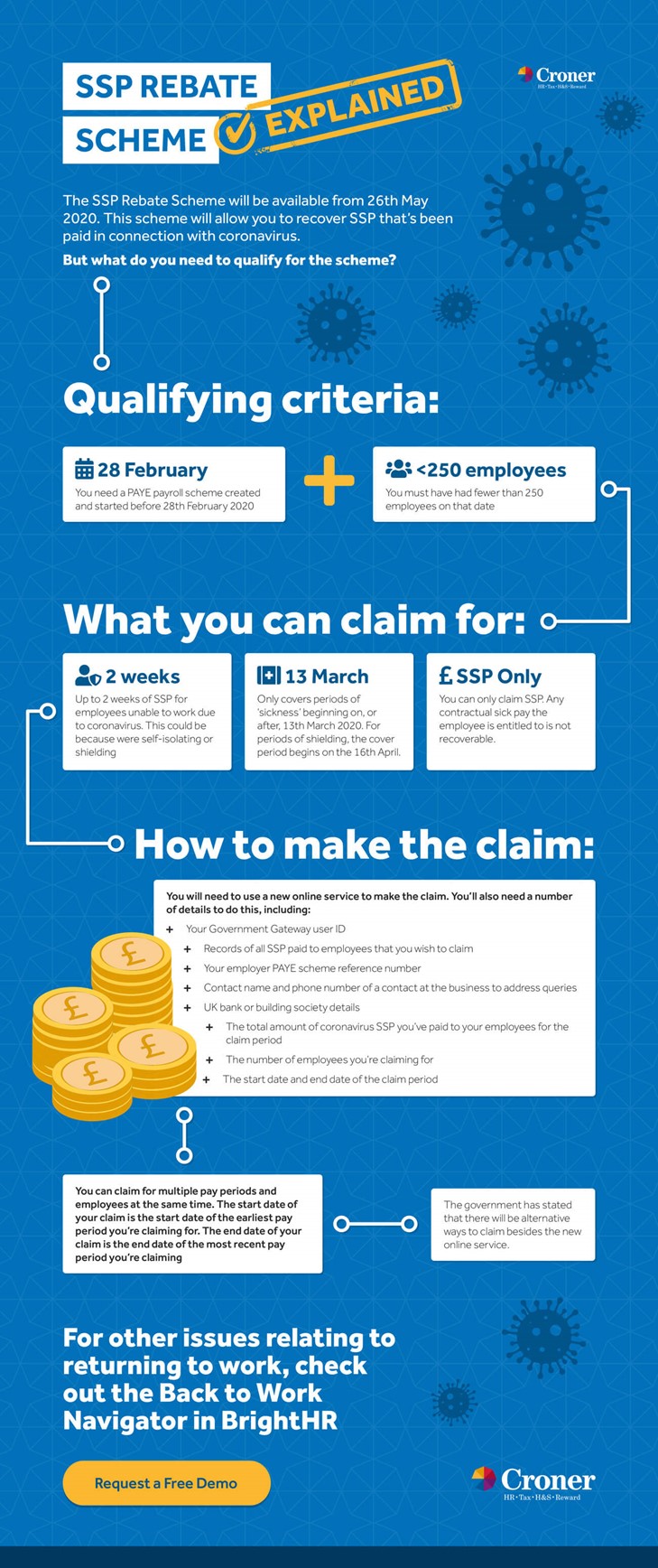

The SSP Rebate Scheme will be available from 26th May 2020. This scheme will allow you to recover SSP that’s been paid in connection with coronavirus. But what do you need to qualify for the scheme?

Qualifying criteria:

- You need a PAYE payroll scheme created and started before 28th February 2020

- You must have had fewer than 250 employees on that date

What you can claim for:

- Up to 2 weeks of SSP for employees unable to work due to coronavirus. This could be because were self-isolating or shielding

- Only covers periods of ‘sickness’ beginning on, or after, 13th March 2020. For periods of shielding, the cover period begins on the 16th

- You can only claim SSP. Any contractual sick pay the employee is entitled to is not recoverable

How to make the claim:

You will need to use a new online service to make the claim. You’ll also need a number of details to do this, including:

- Your Government Gateway user ID to be able to make a claim

- Records of all SSP paid to employees that you wish to claim

- Your employer PAYE scheme reference number

- Contact name and phone number of a contact at the business to address queries

- UK bank or building society details

- The total amount of coronavirus SSP you’ve paid to your employees for the claim period

- The number of employees you’re claiming for

- The start date and end date of the claim period

You can claim for multiple pay periods and employees at the same time. The start date of your claim is the start date of the earliest pay period you’re claiming for. The end date of your claim is the end date of the most recent pay period you’re claiming.

The government has stated that there will be alternative ways to claim besides the new online service. Keep an eye on this page for details on alternative methods of claiming.

For other issues relating to returning to work, check out the Back to Work Navigator in BrightHR.

Related resources

Categories

- Business Advice

- Contracts & Documentation

- Culture & Performance

- Disciplinary & Grievances

- Dismissals & Conduct

- Employee Conduct

- Employment Law

- End of Contract

- Equality & Discrimination

- Health & Safety

- Hiring & Managing

- Leave & Absence

- Managing Health & Safety

- Moving

- Occupational Health

- Pay & Benefits

- Recruitment

- Risk & Welfare