First published 7th June 2020. Last updated 27th July 2021.

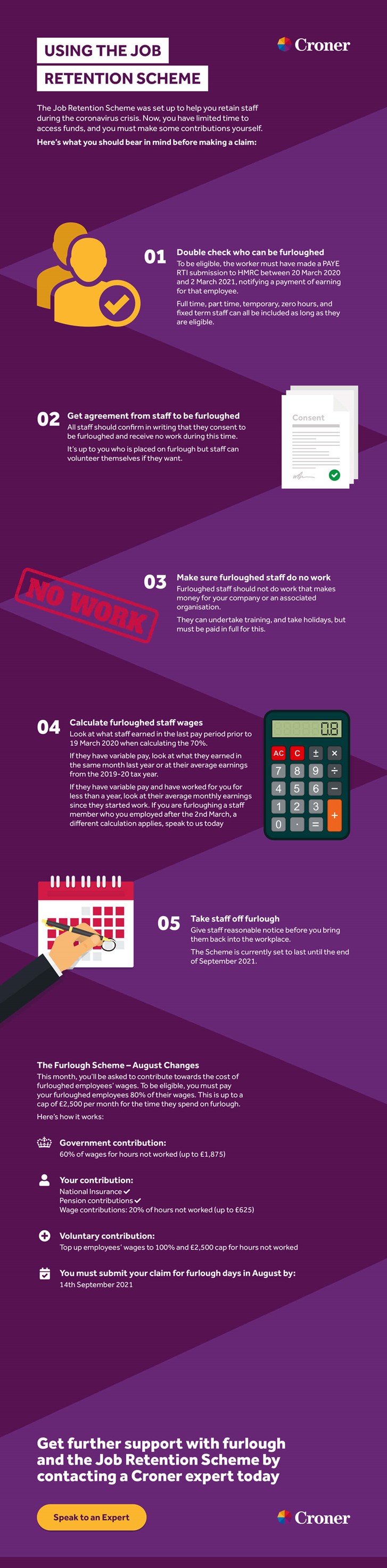

The Job Retention Scheme was set up to help you retain staff during the coronavirus crisis. Now, you have limited time to access funds, and you must make some contributions yourself.

Here’s what you should bear in mind before making a claim:

Add this infographic to your website by copying and pasting the following embed code:

Double check who can be furloughed

To be eligible, the worker must have made a PAYE RTI submission to HMRC between 20 March 2020 and 2 March 2021, notifying a payment of earning for that employee.

Full time, part time, temporary, zero hours, and fixed term staff can all be included as long as they are eligible.

Get agreement from staff to be furloughed

All staff should confirm in writing that they consent to be furloughed and receive no work during this time.

It’s up to you who is placed on furlough but staff can volunteer themselves if they want.

Make sure furloughed staff do no work

Furloughed staff should not do work that makes money for your company or an associated organisation.

They can undertake training, and take holidays, but must be paid in full for this.

Calculate furloughed staff wages

Look at what staff earned in the last pay period prior to 19 March 2020 when calculating the 70%.

If they have variable pay, look at what they earned in the same month last year or at their average earnings from the 2019-20 tax year.

If they have variable pay and have worked for you for less than a year, look at their average monthly earnings since they started work. If you are furloughing a staff member who you employed after the 2nd March, a different calculation applies, speak to us today to find out more.

Take staff off furlough

Give staff reasonable notice before you bring them back into the workplace.

The Scheme is currently set to last until the end of September 2021.

Make your claim

You need to have all of this information to hand:

- your company’s PAYE reference number

- the amount of staff you have furloughed

- the national insurance numbers, names and payroll/works numbers of those being furloughed

- your company’s self-assessment or corporation tax unique taxpayer reference or company registration number

- the start and end dates for the period of furlough being claimed

- the amount that is being claimed as worked out by yourself

- your company’s contact details, bank account number and sort code.

The Furlough Scheme – July Changes

This month, you’ll be asked to contribute towards the cost of furloughed employees’ wages. To be eligible, you must pay your furloughed employees 80% of their wages. This is up to a cap of £2,500 per month for the time they spend on furlough.

Here’s how it works:

Government contribution:

70% of wages for hours not worked (up to £2,187.50)

Your contribution:

- National Insurance

- Pension contributions

- Wage contributions: 10% of hours not worked (up to £312.50)

Voluntary contribution:

Top up employees’ wages to 100% and £2,500 cap for hours not worked

You must submit your claim for furlough days in July by:

16th August 2021

The Furlough Scheme – August Changes

This month, you’ll be asked to contribute towards the cost of furloughed employees’ wages. To be eligible, you must pay your furloughed employees 80% of their wages. This is up to a cap of £2,500 per month for the time they spend on furlough.

Here’s how it works:

Government contribution:

60% of wages for hours not worked (up to £1,875)

Your contribution:

- National Insurance <tick>

- Pension contributions <tick>

- Wage contributions: 20% of hours not worked (up to £625)

Voluntary contribution:

Top up employees’ wages to 100% and £2,500 cap for hours not worked

You must submit your claim for furlough days in August by:

14th September 2021

Expert support

If you need further support with the job retention scheme and furlough or have another HR issue, speak to one of our experts today on 01455 858 132.

Related resources

Categories

- Business Advice

- Contracts & Documentation

- Culture & Performance

- Disciplinary & Grievances

- Dismissals & Conduct

- Employee Conduct

- Employment Law

- End of Contract

- Equality & Discrimination

- Health & Safety

- Hiring & Managing

- Leave & Absence

- Managing Health & Safety

- Moving

- Occupational Health

- Pay & Benefits

- Recruitment

- Risk & Welfare